does north carolina charge sales tax on food

Ergo they are food. Union County collects a 2 local sales tax the maximum local sales tax.

Is Food Taxable In North Carolina Taxjar

Back to North Carolina Sales Tax Handbook Top.

. Do you charge sales tax on shipping in North Carolina. The State of North Carolina charges a sales tax rate of 475. This general rate applies to food prepared and consumed on the premises of full service restaurants and other retail establishments such as taverns and fast food shops that serve food.

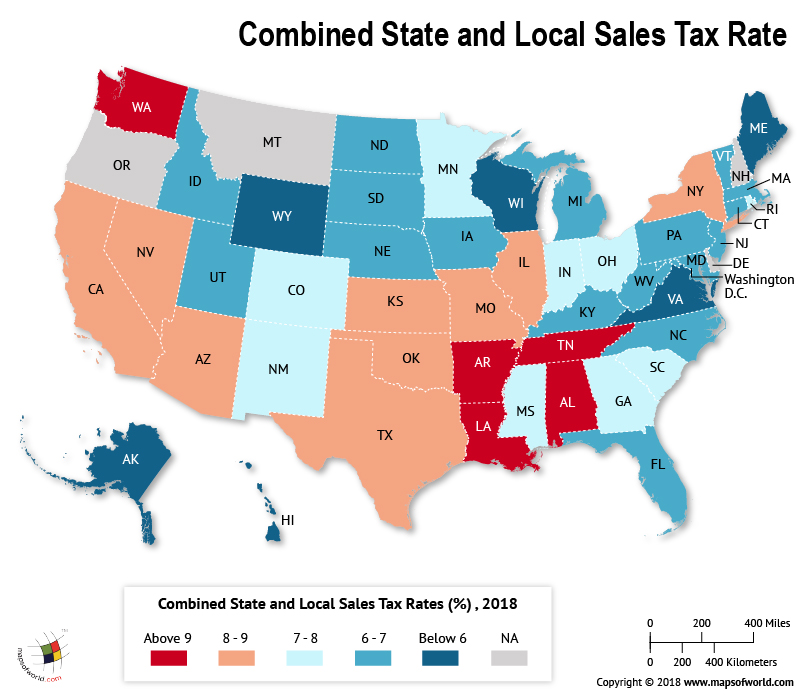

North Carolina doesnt collect sales tax on purchases of most prescription drugs. In North Carolina grocery items are not subject to the states statewide sales tax but are subject to a uniform 2 local tax. South Carolina has no special sales tax jurisdictions with local sales taxes in.

While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Kit Kats contain flour. The Union County Sales Tax is collected by the merchant on all qualifying sales made within Union County.

The sale of food at retail as defined in NC. Sales and Use Tax Rates Effective October 1 2020 Skip to main content Menu. The Union County North Carolina sales tax is 675 consisting of 475 North Carolina state sales tax and 200 Union County local sales taxesThe local sales tax consists of a 200 county sales tax.

A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food. In the state of North Carolina sales tax is legally required to be collected from all tangible physical products being sold to a consumer. However separately stated charges for installation services are excluded from sales tax.

In the state of North Carolina any gratuities that are distributed to employees are not considered to be taxable. North Carolina Sales Tax Rates. Groceries and prescription drugs are exempt from the South Carolina sales tax.

Because each county and city charges a slightly different. Semantics aside in North Carolina. 3 rows But North Carolina does charge the 2 or 225 percent local sales tax on qualifying.

Certain out-of-state sellers will have to start collecting and remitting North Carolina sales tax as of November 1 2018. Prescription Medicine groceries and gasoline are all tax-exempt. Form E-502R 2 Food Sales and Use Tax Chart.

PO Box 25000 Raleigh NC 27640-0640. All shipping handling transportation and delivery charges imposed by the retailer that are in any way connected with the sale of taxable tangible personal property certain digital property and certain services for storage use consumption or otherwise sourced to the State are subject to the North Carolina. North Carolina has a statewide sales tax rate of 475 which has been in place since 1933.

Does North Carolina charge sales tax on out of state sales. This page describes the taxability of clothing in North Carolina. Some examples of items that exempt from North Carolina sales tax are prescription medications some types of groceries some medical devices and machinery and chemicals which are used in research and development.

Candy is subject to the combined state and local sales tax rate. This tax chart is provided for the convenience of the retailer in computing the applicable sales and use tax of Food. 105-1643 is subject to the 2 rate of tax.

Counties and municipalities in North Carolina charge additional sales tax with rates between 2 and 275 for a maximum rate of 75. This page describes the taxability of food and meals in South Carolina including catering and grocery food. While South Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

The following rates apply at the state and city level. Goods that are subject to sales tax in North Carolina include physical property like furniture home appliances and motor vehicles. To learn more see a full list of taxable and tax-exempt items in South Carolina.

Some services in North Carolina are subject to sales tax. Candy however is generally taxed at. Of those thirty-two states and the District of Columbia exempt groceries from the sales tax base.

In the state of North Carolina any and all sales of food are considered to be subject to local taxes. The tax amount is a mathematical computation of the sales price of the Food multiplied by the 2 rate rounded to the nearest whole cent. Groceries and prepared food are subject to special sales tax rates under North Carolina law.

Food Non-Qualifying Food and Prepaid Meal Plans. In most states necessities such as groceries clothes and drugs are exempted from the sales tax or charged at a lower sales tax rate. Non-Qualifying Food Dietary Supplements Food Sold Through a Vending machine Prepared Food Certain Bakery Items Soft Drinks Candy.

Certain purchases including alcohol cigarettes and gasoline may be subject to additional North Carolina state excise taxes in addition to the sales tax. In other words theres no better time for a map looking at how different state sales taxes treat consumable goods like candy groceries and soda. Forty-five states and the District of Columbia levy a state sales tax.

According to statute as recodified and rewritten effective January 1 2004 the definition of sales price includes delivery charges. The sale of prepared food is subject to general State rate of tax of 475 and the applicable local and transit rates of sales and use tax as applicable. North Carolina taxes delivery charges.

Food and food ingredients excluding alcoholic beverages and tobacco are subject to a lower rate of 2. The transit and other local rates do not apply to qualifying food. Even if separately stated delivery charges are subject to sales tax.

Groceries and prepared food are subject to special sales tax rates under North Carolina law. North Carolina Department of Revenue. The South Carolina state sales tax rate is 6 and the average SC sales tax after local surtaxes is 713.

Counties and cities can charge an additional local sales tax of up to 3 for a maximum possible combined sales tax of 9. To learn more see a full list of. Municipal governments in North Carolina are also allowed to collect a local-option sales tax that ranges from 2 to 275 across the state with an average local tax of 2188 for a total of 6938 when combined with the state sales tax.

The North Carolina state legislature levies a 475 percent general sales tax on most retail sales within the state including prepared foods and beverages in restaurants.

Setting Up Sales Tax In Quickbooks Online

How To Calculate Sales Tax Video Lesson Transcript Study Com

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

Is Food Taxable In North Carolina Taxjar

How To Register For A Sales Tax Permit Taxjar

States Without Sales Tax Article

What Is The Difference Between Sales Tax And Use Tax Sales Tax Institute

States With Highest And Lowest Sales Tax Rates

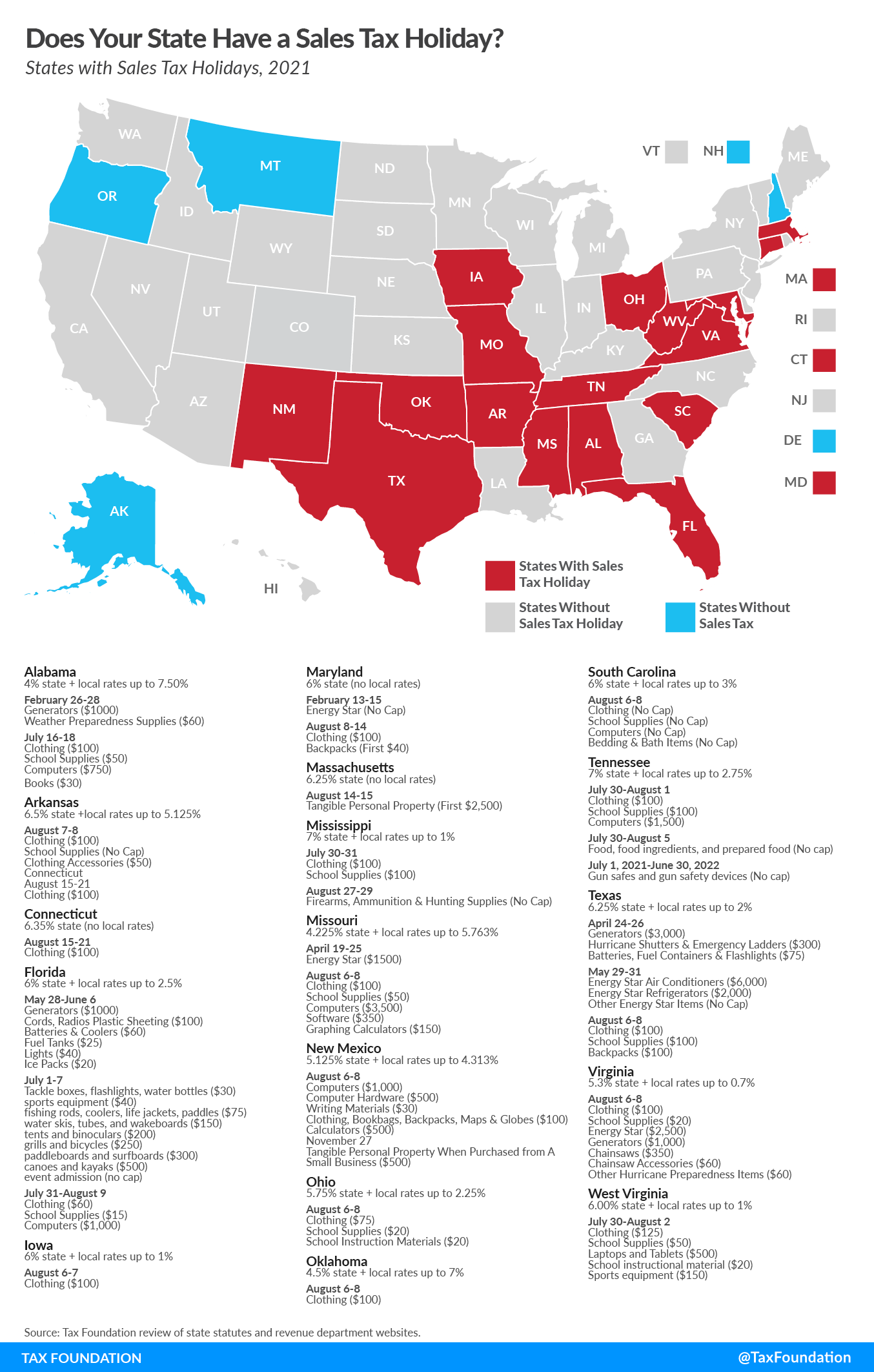

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Amazon Sales Tax What It Is How To Calculate Tax For Fba Sellers

Sales Tax On Grocery Items Taxjar

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Shipping Sales Tax In 2021 Taxability Examples Laws More

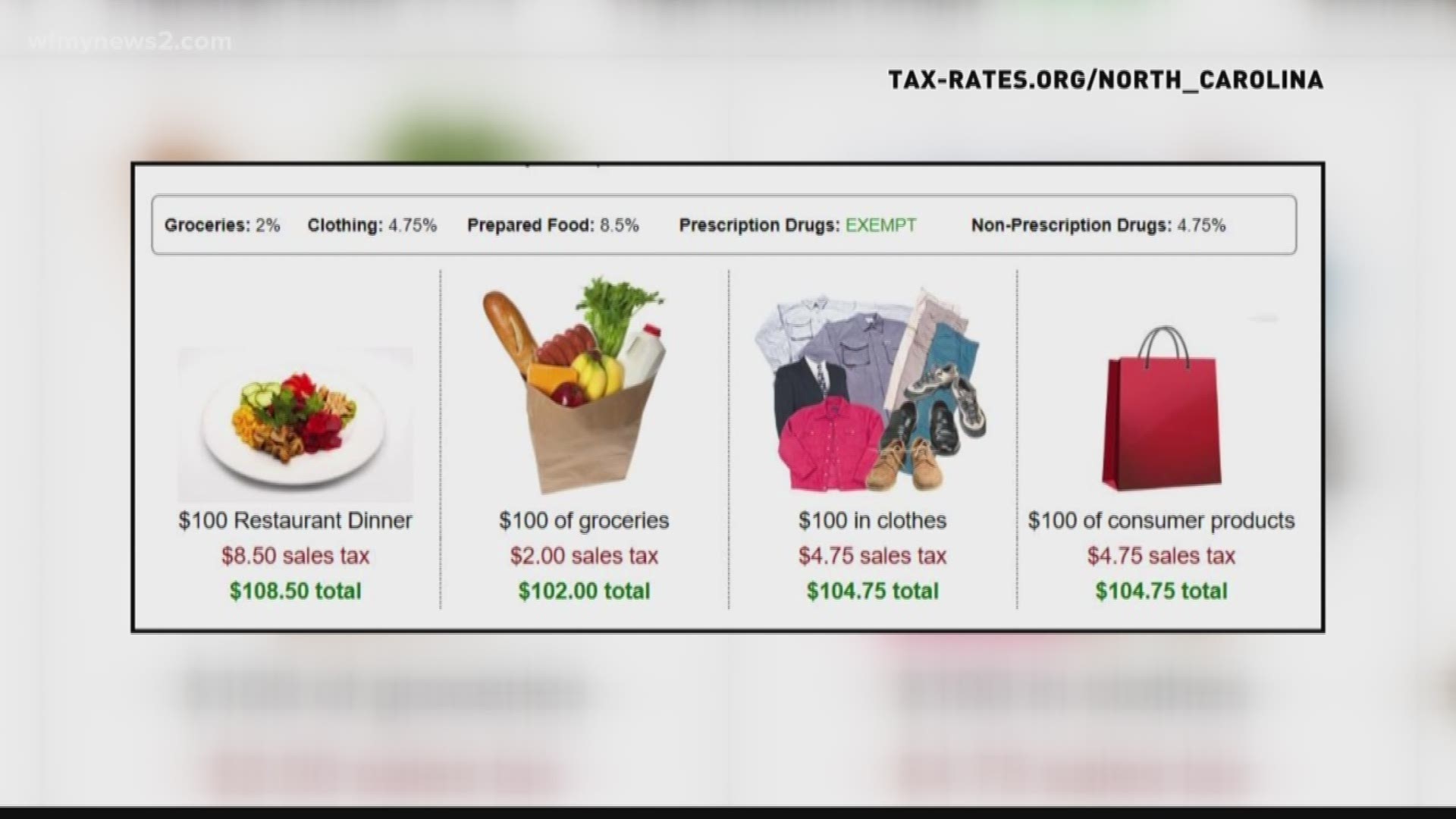

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

North Carolina Sales Tax Small Business Guide Truic

What Is The Combined State And Local Sales Tax Rate In Each Us State Answers

Sales Tax On Grocery Items Taxjar

State Sales Tax Jurisdictions Approach 10 000 Tax Foundation